After the Corona Stock market collapse many people are asking themselves if now is the right time to buy Tesla shares? After the extreme rise in the share price at the beginning of 2020, the price of Tesla shares has fallen massively again since the worldwide spread of the Coronavirus. Could it be that the prices will fall much further with the looming economic crisis? I have been dealing with shares and stock market topics for more than ten years and own, or rather “owned” Tesla shares since 2014. You can read later in this article how it came about that I sold. I have been following the Tesla share price daily for years and in this article I write about my thoughts on the current situation and the future.

ATTENTION: As of August 31, 2020, a 5 to 1 stock split was carried out. This article was written before that date and the share price levels mentioned refer to the level at that time before the split.

Durable 12"x9" sized aluminum sign

Hangs easily anywhere

Will last for years

Shop for more Tesla Accessories here!

The Tesla share price performance to date and important events

Tesla’s share price sometimes resembles a roller coaster ride. Too often buyers and sellers are driven by positive or negative news. In addition, many professional short sellers speculate on sinking prices of Tesla shares, which sometimes leads to downright price manipulation by the “big players” such as hedge funds.

For years the share price moved sideways, while Tesla made losses in most quarters. There are buyers who believe in Tesla’s success and continue to buy shares and sellers who are constantly waiting for Tesla to go bankrupt. This sometimes causes the price to fluctuate strongly and requires good nerves from a long-term investor. The three most significant price rises to a higher level were:

Price rises and their triggers

- 2013: When it became clear that Tesla, with increasing Model S sales, had apparently developed a product that customers were buying.

- 2017: When expectations of the upcoming Model 3 sales showed that Tesla would succeed in penetrating the mass market. The subsequent production problems, however, caused the price to continue to move sideways.

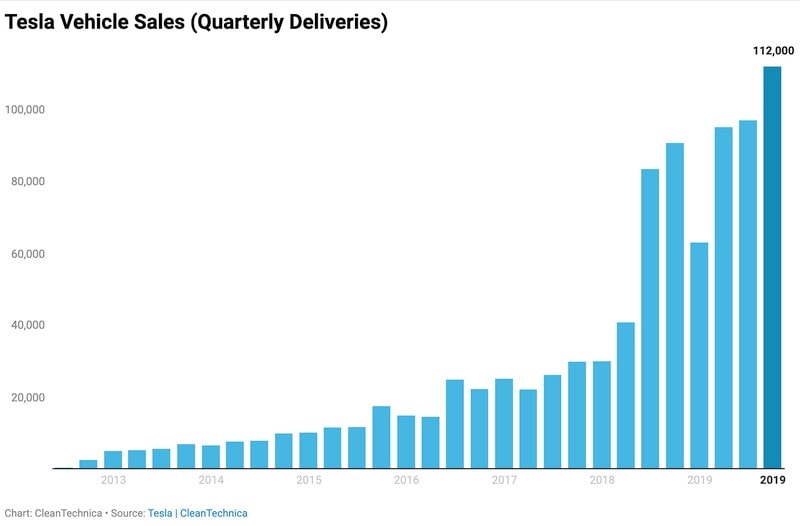

- 2019: When the number of Model 3 sales increased massively and the announcement that Tesla will launch the Model Y in spring 2020 earlier than planned.

Many investors realized that Model Y would generate much more demand on the market than the already successful Model 3. As a result, after years of sideways movement, the price broke out in December 2019 and even the constant attempts of short sellers to squeeze the price could no longer stop a rapid rise in the price at the end of 2019 and the beginning of 2020.

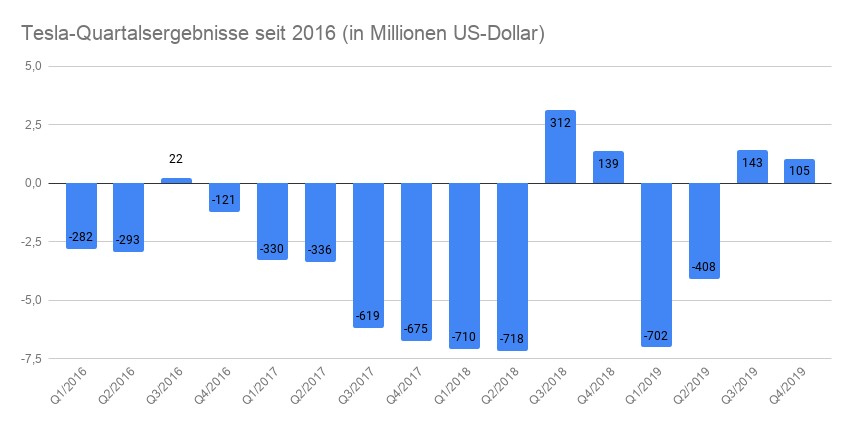

With a market capitalization of 155 billion US dollars, Tesla was now a real heavyweight. The rise came quickly. At the beginning of 2019, the market capitalization was still half that of the previous year, and by the end of May 2019 it had reached just 33 billion US dollars. At that time, many were even betting that the company would go bankrupt, even though Model 3 productions was now running at full speed. Tesla is still not writing high profits, but at least the losses are sometimes contained. The high share price also enabled Tesla to raise fresh money through a capital increase.

How will Tesla survive in the future, they’re only making losses?

If you look at the profits and losses per quarter, Tesla is certainly not a model student for success:

So what drives buyers to believe that even share prices above USD 400 still seem attractive and that buyers will continue to buy Tesla stock? A look at vehicle sales figures shows that since the introduction of Model 3, sales figures have risen massively:

The prospect of further increasing sales figures through the Model Y, as well as the fact that there is no significant competitor besides Tesla that has such a powerful vehicle with a long-distance suitable range and its supercharger network on offer, is exactly the reason why prices have continued to rise at the end of 2019. Many investors did not want to miss the train and realized that Tesla vehicles offer exactly what customers interested in electric vehicles want. And with Autopilot, the resulting “Tesla Network“, the electric semi truck or the solar roof and battery storage division, Tesla is not just a car manufacturer. It is an energy company that is ideally positioned in a future in which climate change is an increasingly prominent topic. All these expectations for the future have quickly pushed the share price to incredible heights.

Perpetual losses

Anyone who thinks that a company that hardly makes any profits will never become anything is wrong. Jeff Bezos founded an online bookstore in 1994. By the end of 1999, his company’s turnover was already around one billion US dollars, but the losses were still 300 million US dollars. Only in 2002 the company made profits for the first time and today Amazon is an online giant with 280 billion US dollars in sales. Eight years of losses and a share price with an unbelievable roller coaster ride: In 1998 the Amazon share price was around 100 US dollars, in mid-1999 the value fell to 50 US dollars, only to rise again to over 100 US dollars at the end of 1999. By 2006, the value of a share had fallen to just 20 US dollars. It was not until 2009 that the share price began to rise continuously again. In August 2013, the value of an Amazon share was over 200 US dollars and at the end of 2019 over 1400 US dollars.

So it does not depend so much on whether a company makes profits. It depends on the business model and whether a market for this business model will develop in the future. With Tesla, it is clear. Why else would all car manufacturers jump on the bandwagon and develop their own electric cars in no time at all? The era of the combustion engine is over, most people are just not aware of it yet. In the future, falling costs will displace gasoline and diesel, just as flat screens replaced tube TVs or smartphones replaced the old mobile phones without touch displays. The electric car is simply the better product and is displacing its competitors step by step through disruption.

Buy now? What about this possible Tesla stock price objective

If you deal with all these topics in more detail you will realize that Tesla is excellently positioned with its products to grow to the size of a company like Google, Amazon or Apple. But where does the journey lead to? What share price could one expect in the future? This is the only way to estimate whether a current investment in Tesla shares will be worth more in five or ten years than it is today. Since Tesla does not pay a dividend, only a potential price gain is a way to generate a return on the investment.

In March 2018 it was announced that the Tesla Supervisory Board had approved a new bonus plan for CEO Elon Musk. The bonus will be paid out in tranches. Musk will receive 1.69 million shares each upon reaching predefined milestones, such as the increase in the value of the company of USD 50 billion each. Each tranche is worth 600 million US dollars at the share price at that time. The stock market value of 59 billion US dollars in 2018 serves as the basis.

Elon Musk will only receive all these shares if Tesla is worth at least 650 billion US dollars in 2028. In March 2018, the share price of Tesla was around 300 US dollars. So much for possible price targets. The successful fund company Ark Invest even considers a share price of USD 7000 to be possible.

What to do if you are not familiar with shares?

After all, the share price has been fluctuating incredibly meanwhile. Maybe you’ll buy Tesla stock directly before a major crash? At the moment the Coronavirus seems to be causing such a crisis. On the other hand, prices seem to be very cheap at the moment, as the price has corrected massively downwards in a very short time.

The most important rules for stock trading

- Only invest money in shares that you do not need and that you could do without in an emergency.

- Never invest borrowed money. No matter how convinced you are of something, it can turn out differently than you think.

- Do not act driven by greed or fear. Emotions are a bad advisor on the stock market. Do not make the psychological mistake that many investors make.

- Think about a plan beforehand how you will react in case of possible price losses or gains. At what profit will you sell? What is the maximum loss you should accept before you sell? Should one buy Tesla stock at lower prices to lower the entry price? Is one prepared to risk even greater losses if the price falls even further? How long should one wait out a loss? With a plan, you are also prepared for bad times on the stock market and do not panic so quickly when prices go down.

- Learn from your experience and reflect on yourself and your behavior (buying/selling). Why did you buy or sell at a particular time? Looking back to see if the decision was a good one and learn from this experience. Stock market has nothing to do with emotions. You need a plan and should follow it through as disciplined as possible. This includes realizing possible losses and being able to pull the ripcord if the plan calls for it. Of course, the plan can also be adjusted if the situation has changed significantly. But it is important to act based on facts and not on emotions. You should also be careful not to deceive yourself to approve a decision that is only based on fear or greed. There is a lot of psychology in trading and owning stocks.

How can I buy Tesla stock?

If you really want to buy Tesla shares, approach the subject slowly and start with small amounts. The trading fees are higher for small amounts, but the losses are more manageable. Only practice makes perfect. To buy and sell Tesla stock, you need a stock portfolio. Most house banks offer such a service, but charge different fees for buying, selling and keeping the shares in the portfolio. Brokers are also an alternative. You can find comparisons for example here.

Conclusion

Of course, I am a fan of Tesla cars, and I am aware that this also influenced my view of the subject somewhat. Nevertheless, I sold all my Tesla shares on the stock exchanges at the beginning of February 2020 about three weeks before the Corona crash. For me, this extreme and fast rise was simply too much for me. Nevertheless, I am still sure Tesla will massively increase in market value in the coming years. But not at the same speed as it happened at the end of 2019. For me, this was only a short-term exaggeration. At the moment the Coronavirus has put a temporary end to all this anyway. Since its peak at around USD 920, stock prices have again fallen massively. But in my opinion this has nothing to do with the Tesla company. There is quite simply panic on the stock market and all stocks are being sold massively. At some point in the future, I will definitely re-enter the Tesla share. When exactly is not clear yet, but I will definitely do it. However, it is difficult to determine the right time and at the moment I am very cautious with the approaching economic crisis. It is better to wait a while longer. That’s why I’m guaranteed to buy Tesla stock at different times and different prices.

As the well-known major investor Warren Buffett once said:

The stock exchange is an instrument to transfer money from the impatient to the patient. – Warren Buffett

In accordance with §34b WpHG, I would like to point out that the author of this blog holds or could hold shares in the respective companies addressed and that there is therefore a possible conflict of interest.

All content is for information purposes only and does not constitute investment advice or an invitation to buy or sell securities or other financial market instruments. All information and data in the publications are taken from sources that the publisher considers reliable and trustworthy during writing.

My USB Flash Drive recommendations for Sentry Mode and Dashcam: